Cash Flow Diagram Example Problems

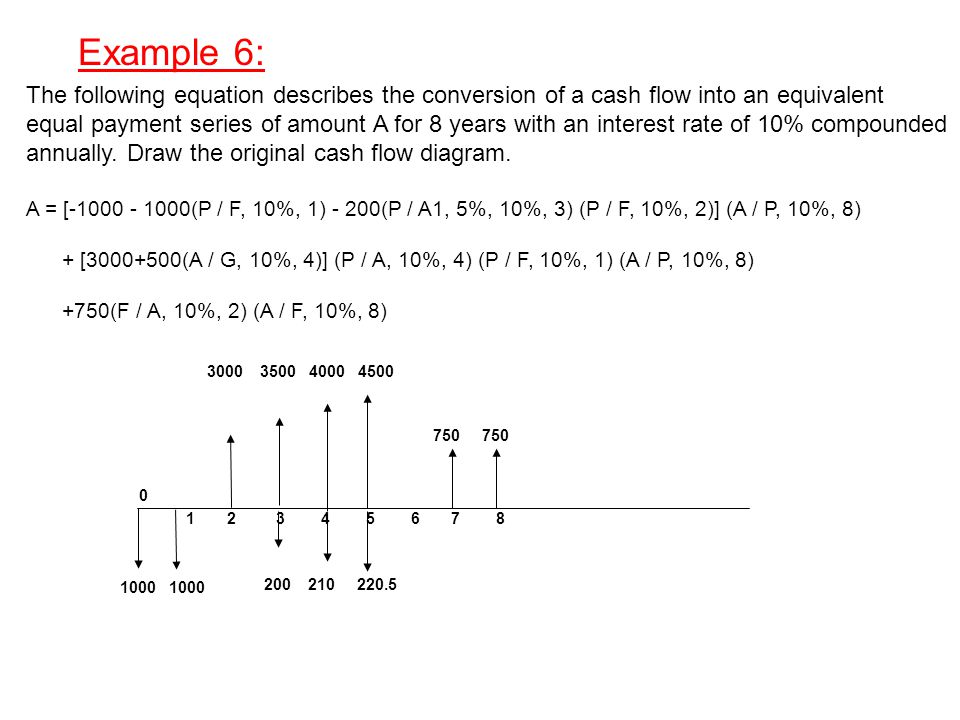

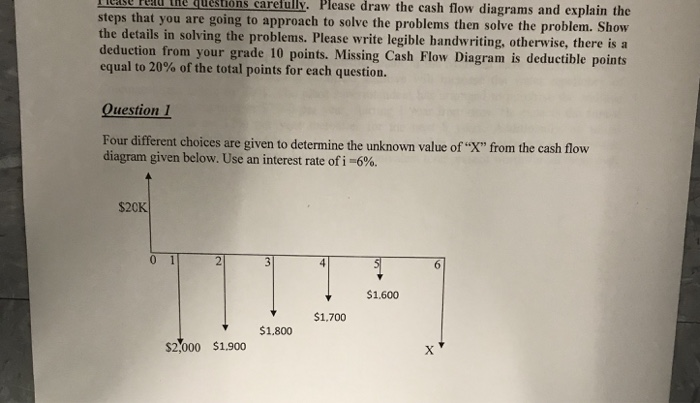

Problems), cash flow diagrams can be drawn to help visualize and simplify problems that have diverse receipts and disbursements. The base amount and the gradient series.

Cash Flow Diagrams

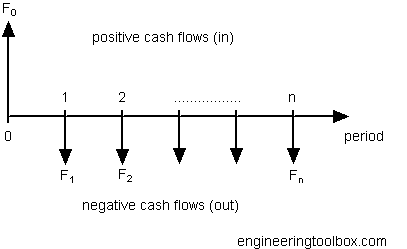

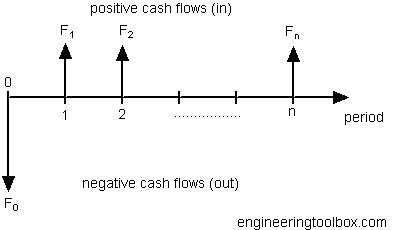

.and then add arrows to represent the inflows (arrows pointing from the line) or outflows (arrows pointing to the line) of cash.

Cash flow diagram example problems. Here is the cash flow diagram: Low profits or (worse) losses. The meaning of cash flow statement or statement of cash flows can be defined as ‘cash flow statements exhibit the flow of incoming and outgoing cash.

A loan of p100 simple interest of 10% will become p150 after 5 years. There’s a fair amount to unpack here. We will use them in many of our problems.

The profit a business makes from trading is the most important source of cash. This statement is one of the tools for assessing the liquidity and solvency of the enterprise’. Just as with auxiliary tables, cash flow diagrams can be split into separate equivalent diagrams.

But here’s what you need to know to get a rough idea of what this cash flow statement is doing. The profit for 2006‐2007 was rs.8,600 against this had been charged dep. Every cash flow diagram contains the following components:

3,050 and increase in provision for doubtful debt rs.200 2. At time t = 1, 2, 3, and 4, four positive or inflow cash flows occurred. During the same period it issued shares of rs.2,00,000 and redeemed debentures of rs.1,50,000.

Having excess or incomplete inventory is one of the typical cash flow example problems and solutions like having good inventory management will not only help in avoiding being out of stock or overstocked but also in keeping track of the company’s overall sales. (iii) cash payments of salaries and wages: Why it causes a cash flow problem.

Disbursement (negative cash flow or cash outflow) this diagram may be drawn according to the following viewpoints: It will cost $9,500 each year to operate including fuel and maintenance. Use the preceding information to compute the following:

P 0 1 2 3 4 n. 0 1 2 3 4 n. The above diagram indicates that at time t = 0, which generally represents today or the present, a negative cash flow of c dollars occurred.

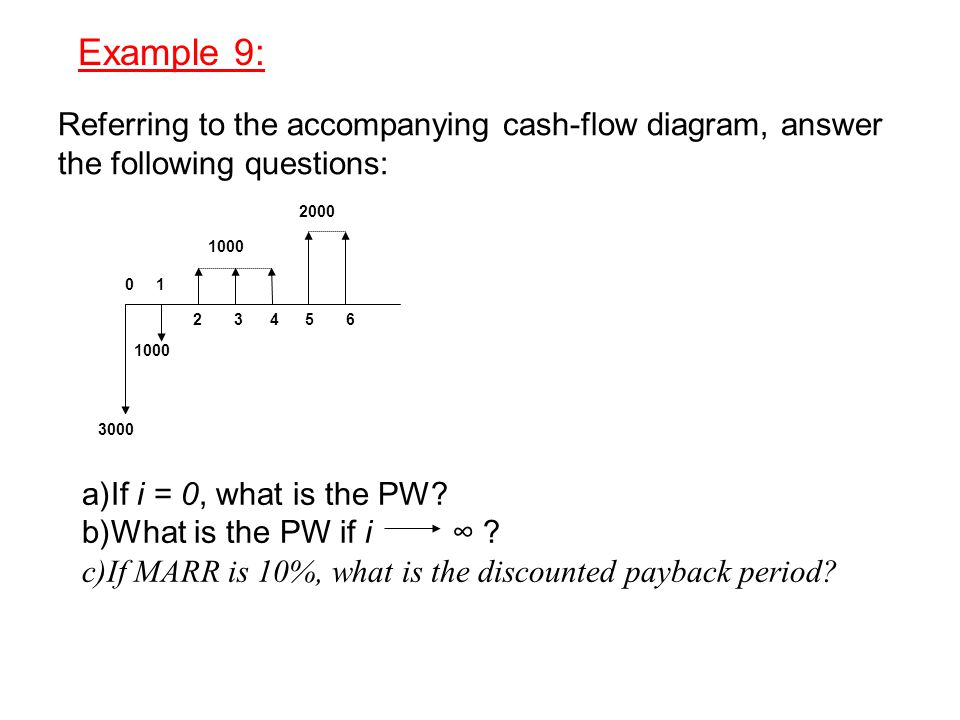

From our simple interest example: What is the present worth in year 0 of the payments if the interest rate is 8% per year? Example of a cash flow statement.

Cash paid to suppliers for inventory • the horizontal (time) axis is marked off in equal increments, one per period, up to the duration of the project. Present value cash flow flow calculator;

P = p 100 0 1 2 3 4 5. The company does not have any cash equivalents. After taking the following information in to account, prepare a cash flow statement for the year ending 31.12.2007 1.

It is used in financial modeling and valuation. It will need to have its engine rebuilt in 6 years for a cost of $22,000 and it will be sold at year 9 for $6,000. This statement assesses the ability of the enterprise to generate cash and to utilize the cash.

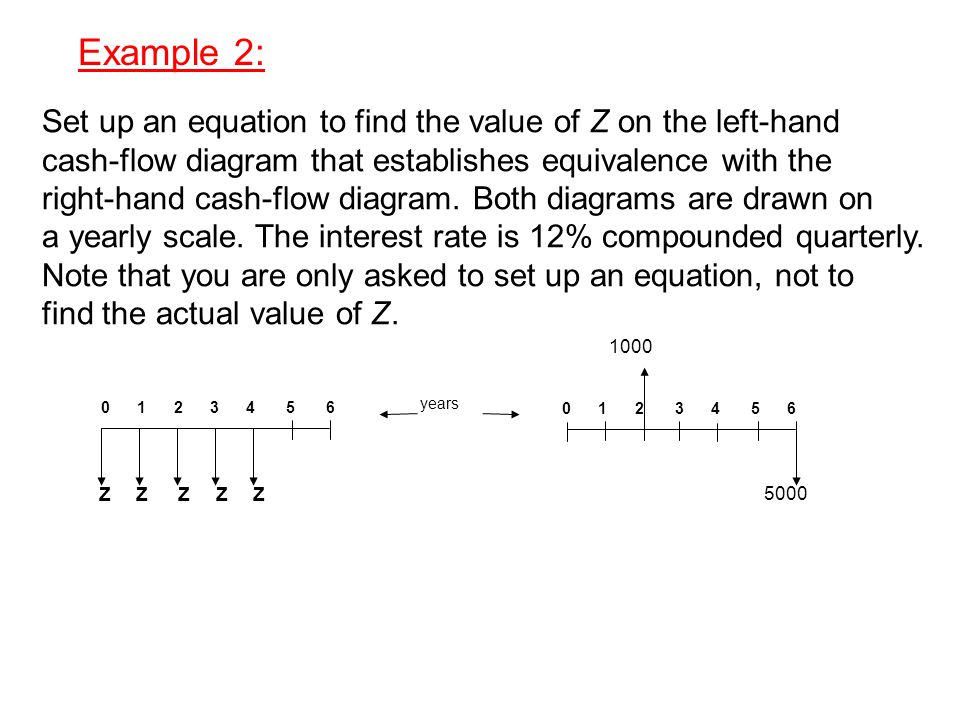

Here is a compilation of top three accounting problems on cash flow statement with its relevant solutions. Example 1 the offshore design group at bechtel just purchased upgraded cad software for $5000 now and annual payments of $500 per year for 6 years starting 3 years from now for annual upgrades. Cash flow diagram on the viewpoint of the lender f= p150.

Now that we’ve got a sense of what a statement of cash flows does and, broadly, how it’s created, let’s check out an example. Here is a compilation of top nine problems on cash flow statements along with its relevant solutions. Statement of cash flows direct method example assume that accounts payable was only used to acquire inventory.

Cash flow diagram example 2021. For example, consider a truck that is going to be purchased for $55,000. The negative or outflow of dollars is reinforced with either the negative sign or the downward pointing arrow (or both!).

The following conventions are used to standardize cash flow diagrams. The bank balance of a business firm has increased during the last financial year by rs.1,50,000. The present value of the cash flows can be calculated by multiplying each cash flow with a discount rate.

(ii) cash paid to suppliers of raw materials: Read more about fcff unlevered free cash flow unlevered free cash flow is a theoretical cash flow figure for a business, assuming the company is completely debt free with no interest expense.

Cash Flow Diagrams

Time Value Of Money

Solved Question The Cash Flow Diagram Of A 12 Months Cheggcom

Example 1 In The Following Cash Flow Diagram A8a9a10a115000 And - Ppt Video Online Download

Time Value Of Money

Example 1 In The Following Cash Flow Diagram A8a9a10a115000 And - Ppt Video Online Download

Engenieering Economic Analysis Arithmetic Gradient Factors P G And A G

Solved Nelesions Caretully Please Draw The Cash Flow Cheggcom

Cash Flows Compound Interest Cash Flow - Inflow Outflow Of Money

Cash Flow Diagrams

Cash Flows Compound Interest Cash Flow - Inflow Outflow Of Money

Tvm-eb 10 Help

Cash Flows Compound Interest Cash Flow - Inflow Outflow Of Money

Example 1 In The Following Cash Flow Diagram A8a9a10a115000 And - Ppt Video Online Download

Cash Flow Diagrams

Time Value Of Money

Example 1 In The Following Cash Flow Diagram A8a9a10a115000 And - Ppt Video Online Download

Time Value Of Money

Example 1 In The Following Cash Flow Diagram A8a9a10a115000 And - Ppt Video Online Download