Operating Cash Flow Ratio Negative

Download the cash flow ratios spreadsheet and article in pdf. You can use the operating cash flow margin calculator below to quickly calculate the operating cash flow of a company by entering the required numbers.

Cash Flow Formula How To Calculate Cash Flow With Examples

He argued that higher current assets (uses of cash) and lower current liabilities (uses of cash) lead.

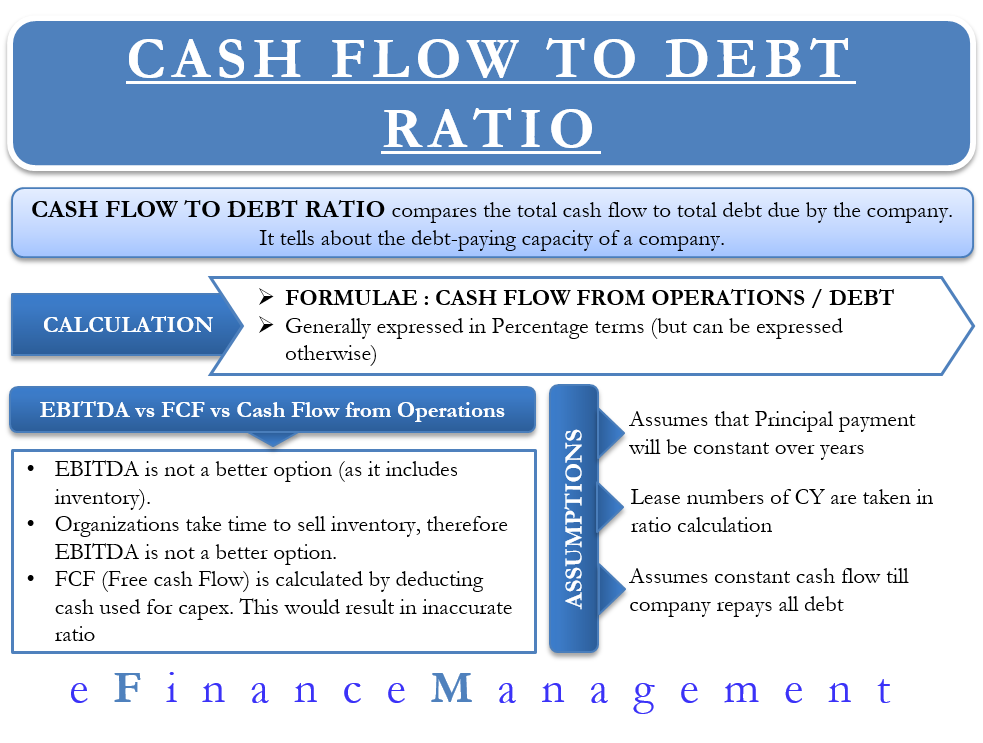

Operating cash flow ratio negative. The operating cash to debt ratio is calculated by dividing a company’s cash flow from operations by its total debt. A negative operating cash flow margin is an indication that the company is not making any profit but rather losing money. The ratio serves as a measurement of the company’s liquidity.

If your receivables less your payables results in a negative number, you have negative cash flow from operations. In the first, liquidity indicators, the most useful ratios are operating cash flow (ocf), funds flow coverage (ffc), cash interest coverage (cic) and cash debt coverage (cdc). Operating cash flow margin calculator.

Study revealed that operating cash flow has a significant and strong positive relation with performance in the banking sector in nigeria, it was also reified that investing cash flow and financing cash flow have negative and weak relationship. It may also be known as operating cash flow minus capital expenditures. During these airlines’ severe financial distress in the past few years, their annual operating cash flows were negative.

Cash from financing is positive and cash from operations is negative which is a red flag. Free cash flow is actually the net cash that is left after paying off all the expenses. Operating cash flow (ocf) is cash generated from normal operations of a business.

You’re making too little sales or you’re spending too much. This may signal a need for more capital. The cash flows from ancillary activities are excluded from this calculation.

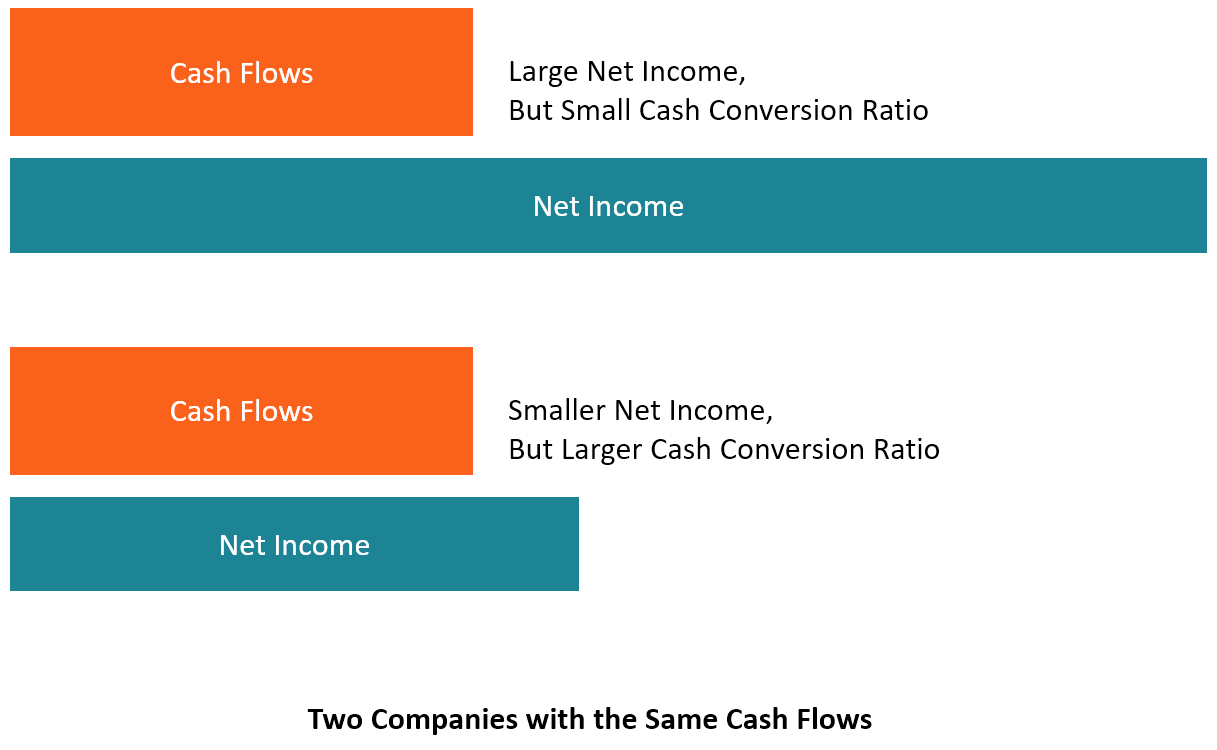

Cash flow from operations ÷ net income = operating cash flow ratio. Ideally, the ratio should be fairly close to 1:1. As part of the cash flow statement the cash flows of the operating activities, investing activities, and financing activities are segregated so the analyst can get a clear picture of the cash flows of all the company’s activities.

Interpretation of operating cash flow ratio. The operating cash flow ratio is a measure of a company's liquidity. The study recommends that regulatory authorities such as cbn, sec, cac and ndic should be securitizing.

Yet pan am has survived, while braniff filed for bankruptcy in may 1982. Click any of the social buttons on the blog to get the download link to the nicely organized list of cash flow ratios. So a ratio of 1 & above is within the desirable range.

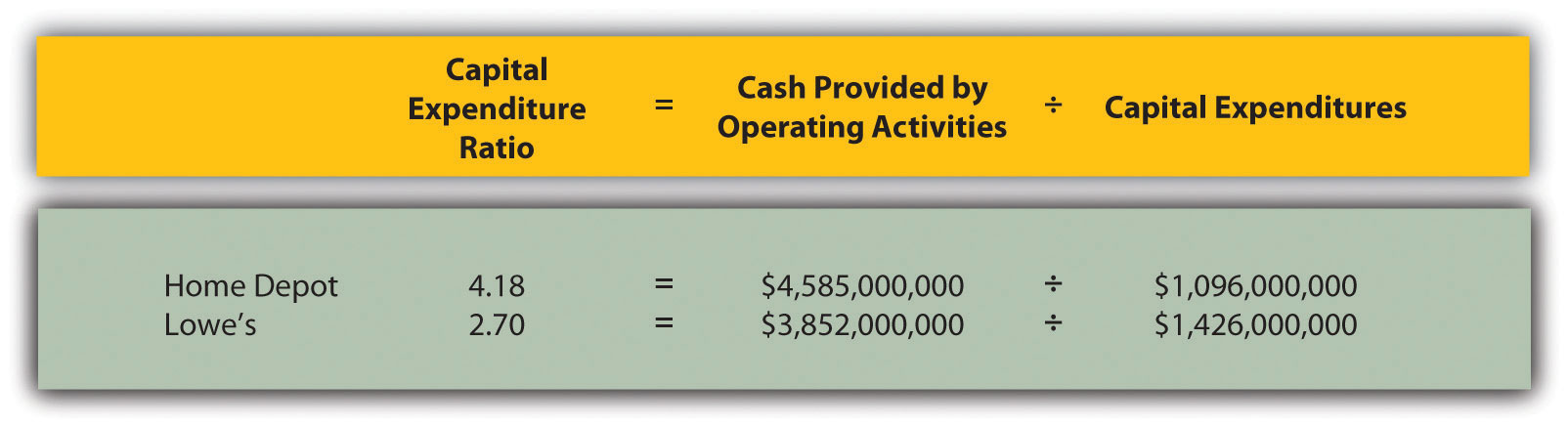

1.1.1 importance of cash flow ratios 16 1.1.2 use of cash flow ratios as a predictor to failing business 20 1.1.3 relative performance evaluation using ratios 24 1.1.4 accounting for and reporting cash flows 25 1.1.5 financial statements information and the role of. In the second category, ratios used to assess a company's strength on an ongoing basis, we like total free cash (tfc), cash flow adequacy (cfa), cash to capital expenditures and cash to total debt. An operating cash flow ratio of less than one indicates the opposite—the firm has not generated enough cash to cover its current liabilities.

There is no standard guideline for operating cash flow ratio, it is always good to cover 100% of firm’s current liabilities with cash generated from operations. A company with negative cash flow doesn’t signify that it is bad because new companies usually spend a lot of cash. The amount of your income is less than the expenses you must pay.

To investors and analysts, a. Low cash flow from operations ratio i.e. The formula to calculate the ratio is as follows:

Below 1 indicates that firm’s current liabilities are not covered by the cash generated from its operations. If you are reading via email or rss, you’ll have to come to the blog to get it. Also ljj found that cash flows from operations has a negative relationship with current ratio.

How can we calculate the operating cash to debt ratio? A negative ocf shows that the company has not enough revenues from its major business activities and needs to reproduce a positive cash flow from additional investments and financing. In some cases, having negative cash flow investments could be a warning sign that management is not efficient at using the company's assets to generate revenue.

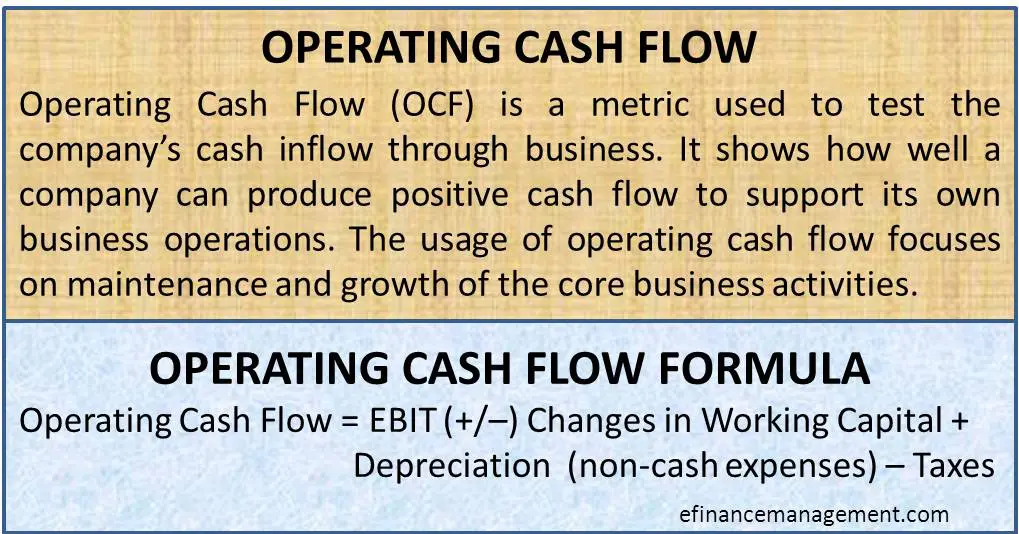

Operating Cash Flow Efinancemanagementcom

Operating Cash Flow Ratio - Formula Guide For Financial Analysts

Cash Flow To Debt Ratio Meaning Importance Calculation

Negative Cash Flow Investments In Companies

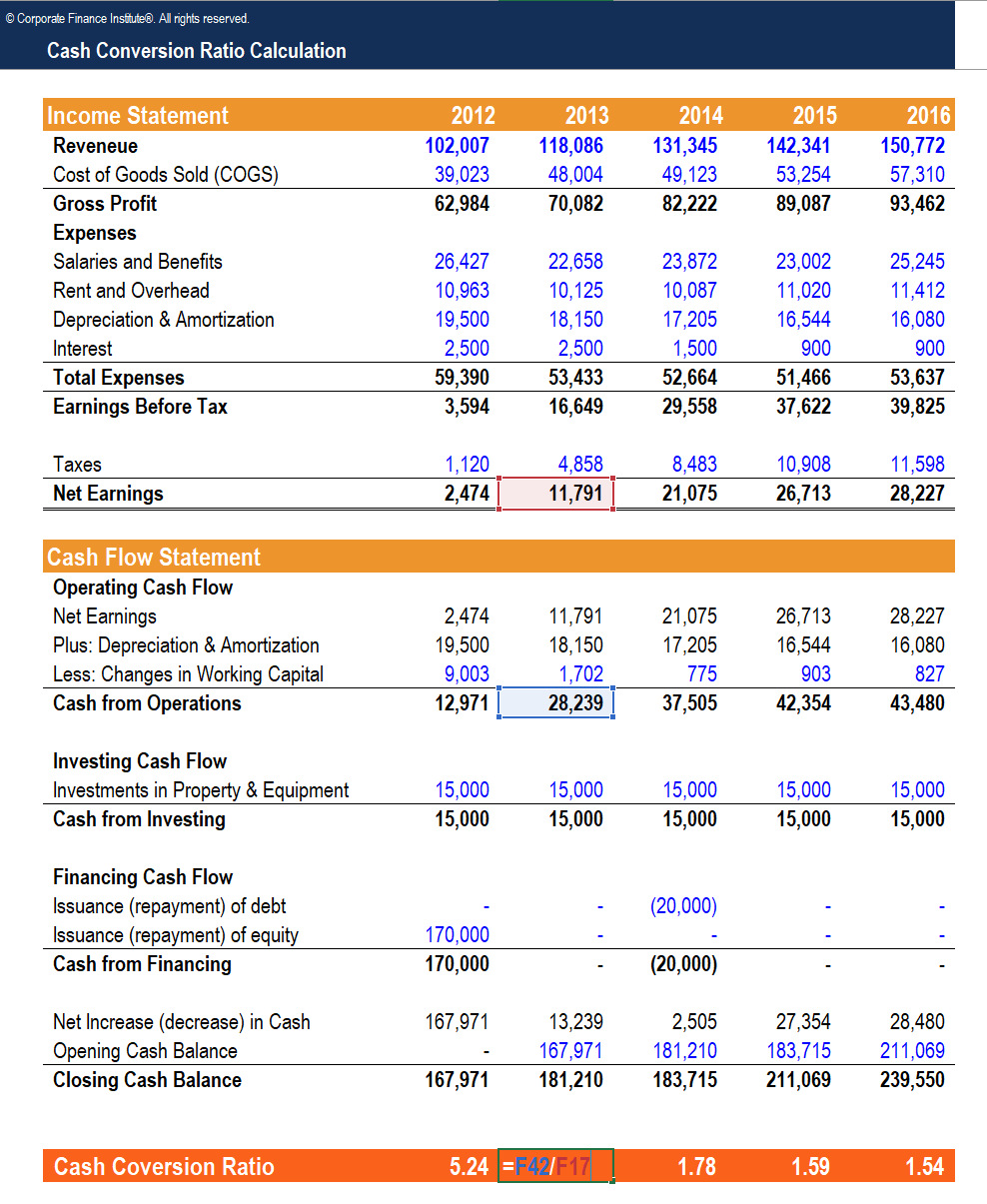

Cash Conversion Ratio - Comparing Cash Flow Vs Profit Of A Business

How Is The Statement Of Cash Flows Prepared And Used

Cash Flow From Operating Activities Direct And Indirect Method Efm

Operating Cash Flow Ratio Definition And Meaning Capitalcom

Operating Cash Flow Formula Calculation With Examples

Free Cash Flow Formula Calculator Excel Template

Cash Conversion Ratio - Comparing Cash Flow Vs Profit Of A Business

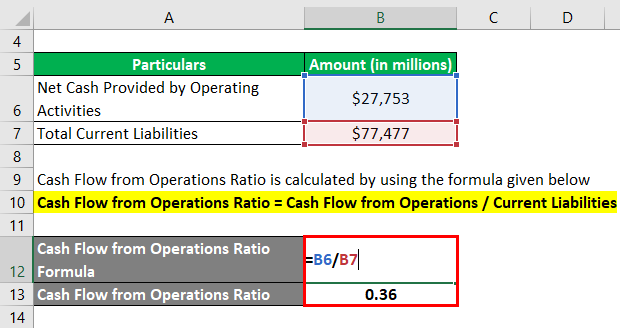

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Price To Cash Flow Ratio Formula Example Calculation Analysis

Cash Flow Statement Analysis Double Entry Bookkeeping

What Is Operating Cash Flow Ocf - Definition Meaning Example

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Summary Of Cash Flow From Operations Abstract

Cash Flow Formula How To Calculate Cash Flow With Examples